August 1, 2023

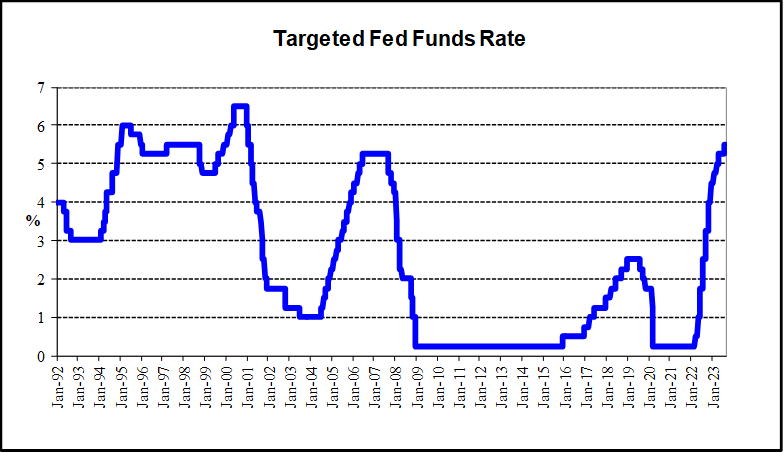

Following June’s Federal Open Market Committee (FOMC) meeting, Federal Reserve Chairman Jerome Powell highlighted the three stages of the central bank’s hiking strategy. They are, “the speed of tightening, the level to which rates go, and then a period of time over which we’d need to keep policy restrictive.” The phase of the rapid rise of policy rates, 500 basis points worth of rate hikes in 14 months (March 2022 through May 2023), is done and now every FOMC meeting is a “live” meeting of “go or no go” as it tries to find the right level of interest rates.

After a pause in rate hikes at the June FOMC meeting, intended to slow the pace a rate increases, the Fed resumed raising rates at the July meeting. Federal Reserve policymakers unanimously elected to increase the targeted fed funds range by 25 basis points to 5.25% to 5.50%, the highest level in 22 years. The Fed’s hiking of rates came 2 weeks after a promising inflation report, featuring a decline in the year-over-year headline CPI level to 3.0%. In the policy statement and in Chairman Powell’s post-meeting comments all options were kept open, the Fed remains data dependent going forward, inflation is still too high and the Fed could tighten again. The central bank needs to slow economic activity enough to bring supply and demand closer into balance to bring inflation to heels.

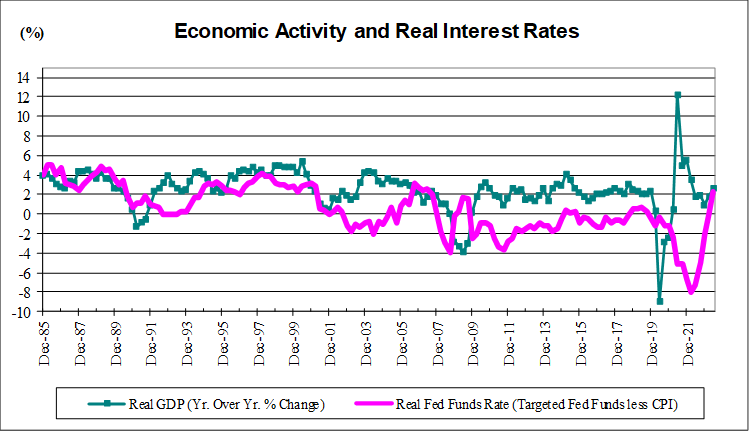

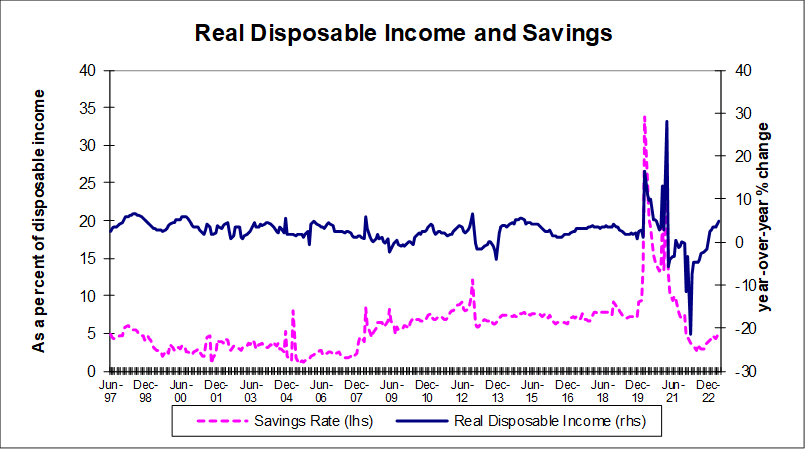

The economy has weathered the headwinds of tighter monetary policy surprisingly well and has outperformed expectations. Gross Domestic Product (GDP) grew at a seasonally and inflation adjusted annual rate of 2.4% in the quarter ending June 30th. This was up from the 2.0% annual growth rate registered in the first quarter. The resilience in consumer spending, which makes up roughly two-thirds of GDP, has kept the economy growing solidly during the first half of the year. With the labor market still tight, consumers have been able to weather the headwinds of higher prices and higher interest rates.

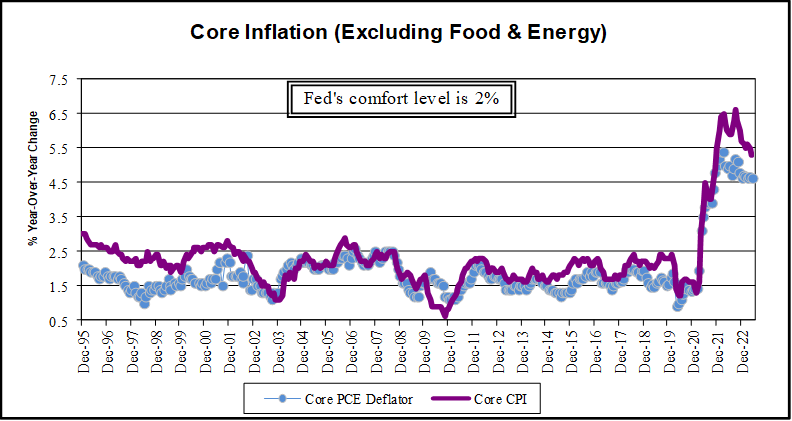

The cooling of price pressures has been gradual as recent softening in the labor market and consumer spending has been tentative, but a downward trend in inflation has become apparent. The headline reading of both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Deflator posted sharp declines in June, largely due to the base effects of comparing June of 2023 to June of 2022 when the effects of the Ukrainian-Russian conflict were highly evident. More pertinent to the Fed, however, is the deceleration of the core, excluding food and energy, measures. Year-over-year core CPI at 4.8% and core PCE at 4.1% are at their lowest levels since November of 2021, but still more than double the Fed’s target of 2.0%.

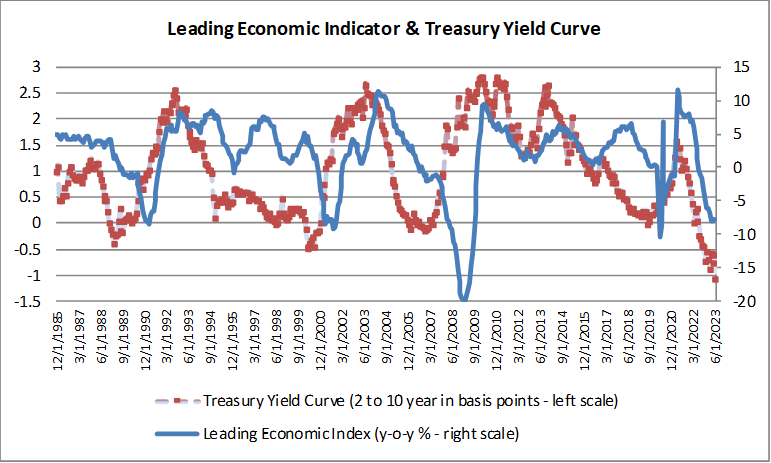

The inflation backdrop has improved, but inflation is still running substantially above the Fed’s goal, and the potential of mild shocks causing rising prices remains a significant concern. The Fed wants to see a slower pace of hiring, alongside tame wage growth, to weigh on consumer spending in the months ahead. Still, as the speed phase of raising rates did not slow the economy as much as expected, the Fed still has mildly hawkish bias. The central bank showed in June its willingness to pause, or skip, a rate hike at every FOMC meeting. By creating longer gaps between rate decisions to observe a larger subset of data, it facilitates the Fed finding the right level of interest rates, or policy settlings, which should limit the risk of a policy overshoot. Thus, the Fed will be data dependent as two predictive measures, Leading Economic Indicators and the yield curve suggests recession risks remain elevated.

Full Fusion

Full Fusion